- January 24, 2022

INREV infographic | Investment Intentions Survey 2022

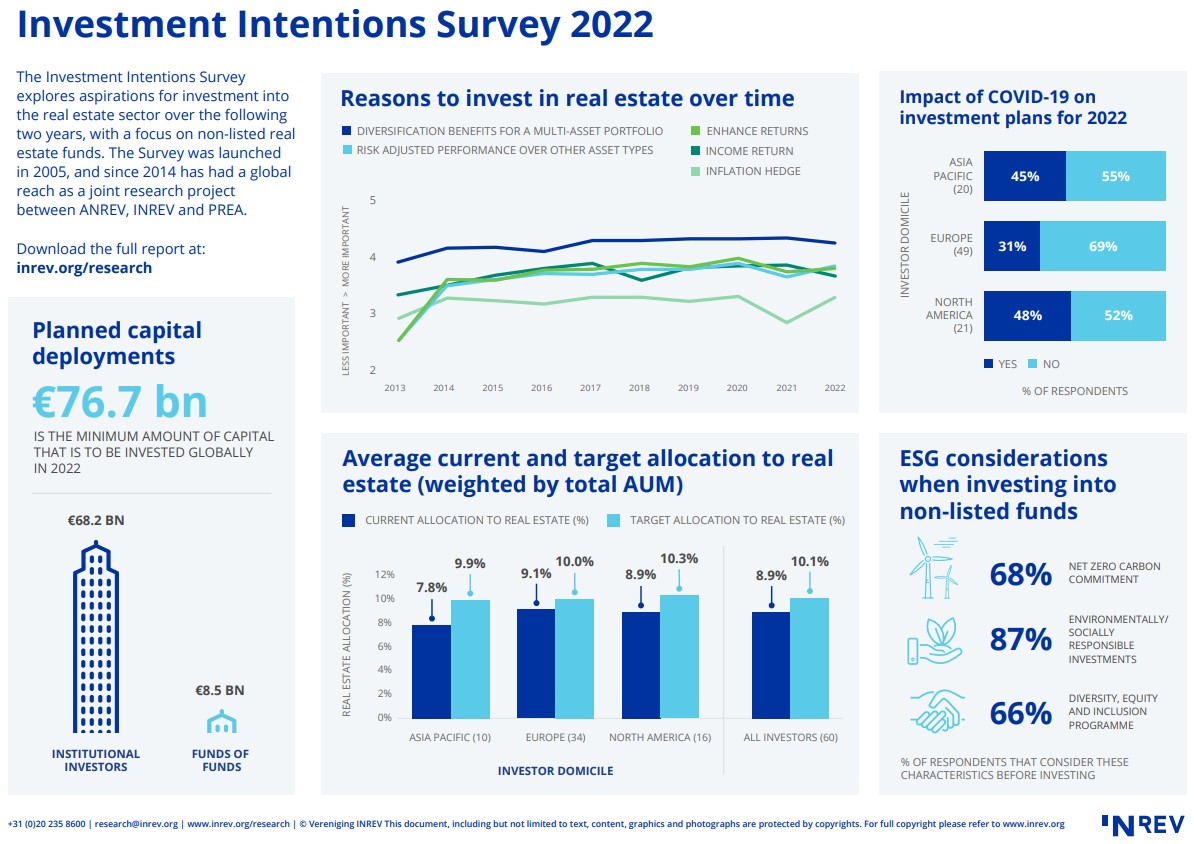

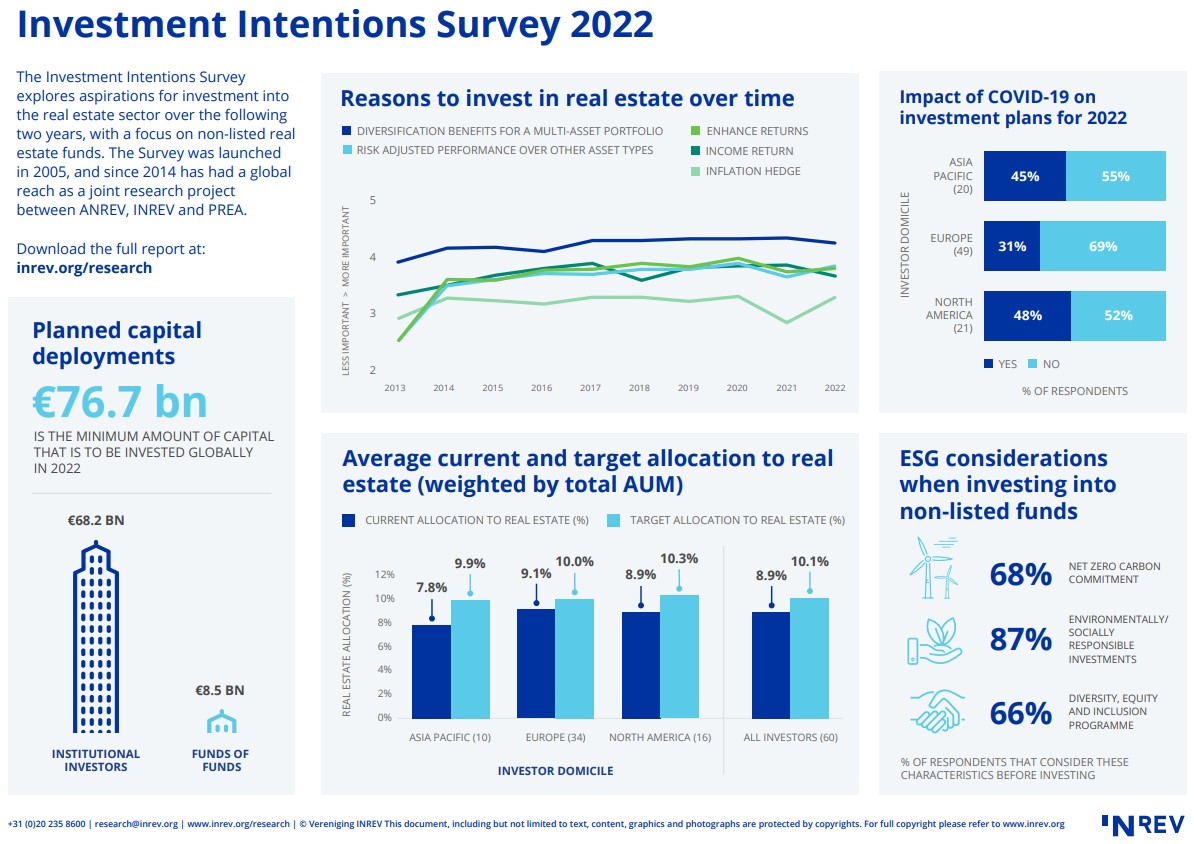

Results of this years’ edition of the ANREV/INREV/PREA Investment Intentions Survey indicated at least €76.7 billion is expected to be invested into global real estate in 2022.

This is a significant improvement on the €64.6 billion that was recorded in 2021. Institutional investors account for €68.2 billion of the planned capital deployments, where European investors are responsible for the lion share (52%), followed by investors from North America (26%) and Asia Pacific (21%). Funds of funds expect to invest another €8.5 billion.

This year respondents were asked about their ESG considerations when investing into non-listed real estate funds. The majority of which indicated they do play a role when making investment decisions. Specifically, 68% of investors globally consider a Net Zero Carbon commitment an important feature in a non-listed fund, while promoting environmentally and socially responsible investments or targeting bespoke sustainable investments is preferred by 87% of investors. Additionally, funds that have an established diversity, equity and inclusion (DEI) programme, are favoured by 66% of investors.

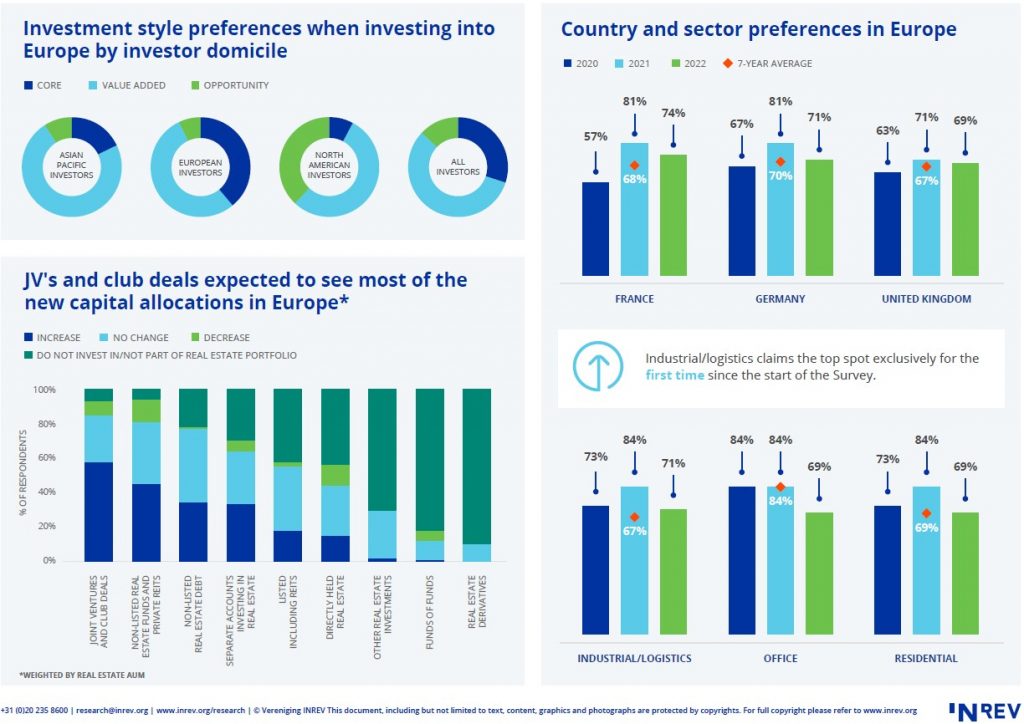

Looking at preferences when investing into Europe at the country level, France is the most favoured destination by investors. It overtakes Germany which held the top spot last year, and is now in second place. The UK, like last year, completes the top three. While the three largest markets are still dominating investor preferences, a notable shift towards second-tier markets in Southern Europe and the Nordics can be observed in 2022.

Turning to sectors, industrial/logistics claims the top spot exclusively for the first time since the start of the Survey, underpinned by continued strong performance. Offices and residential are tied in second place, where for the former momentum is down sharply compared to previous years as investors reassess the future of the office market in response to COVID-19.

On an equally weighted basis, the most likely route to access European markets is via non-listed real estate funds, which shows the largest share on an expected increase among investors surveyed. The second most preferred route to European real estate, based on the expected increase, is the joint ventures and club deals category. This vehicle type is actually on top of the list when weighted by investors’ assets under management.

Specialized structures like joint ventures and club deals as well as non-listed real estate debt and separate accounts enable investors of a certain scale to be even more effective and flexible in deploying strategies. Access to expert management keeps its position as the main reason to invest in non-listed real estate funds for investors, while the costs associated with investing into non-listed funds is cited to be the most challenging obstacle for the first time since the start of the Survey in 2005.

The full report is available to members at inrev.org/research.