- March 6, 2025

GRESB 2025: the 12 key updates that REAL ESTATE participants cannot miss this year!

On 24th February, GRESB released its 2025 Reference Guide, Asset Spreadsheet, Technical FAQ and Scoring Document, providing key clarifications and final confirmations of the updates first announced in late 2024 (see the relevant weblink here). With the GRESB Portal opening for submissions on 1st April 2025 for three months, now is the right time for participants to review the changes and prepare their assessment strategies.

Our team at E.S.G. Solutions has analysed the new documentation in detail. Below, we highlight the most notable updates impacting this year’s assessment cycle:

- Restructured Reference Guide for greater clarity

The introduction to the Standards and Reference Guide has been updated to focus on core content while improving navigation and clarity. These changes aim make it easier to find important information and ensure a more streamlined user experience.

- The Reference Guide Appendices have been restructured and updated to include additional guidance.

- A new Appendix highlighting the minor assessment changes (i.e. those not announced at the end of 2024) made to Reference Guide.

- Scoring details and peer group functionality have been moved to separate output-related documents for easier reference.

- A new section, “Real Estate Assessment Output,” has been introduced to highlight participant outcomes and tools, providing greater clarity on results, benchmarks, and actionable insights.

- More transparency in Quality Control Processes (QCP)

GRESB has introduced additional details on its quality control and validation processes, aimed at improving transparency.

- Expansion of accepted reporting frameworks

GRESB have added new international sustainability reporting frameworks/guidelines, including:

- European Sustainability Reporting Standards (ESRS)

- International Sustainability Standards Board (ISSB) IFRS S1 and IFRS S2

- Changes to data monitoring & review indicators (MR1-MR4)

GRESB now allows entities undergoing data assurance or verification for the first time to submit a confirmation letter from their auditor stating that the assurance or verification is in progress and valid.

Additionally, GRESB has reiterated that verification and assurance are treated equally in the real estate assessment and added separate definitions for both verification and assurance.

- New exception criteria for policy indicators (PO1, PO2, PO3)

GRESB has introduced new exception criteria for policy indicators PO1, PO2, and PO3, acknowledging that policies may remain unchanged over time. Entities that achieved full points in these indicators in the previous year and are keeping their responses and evidence the same will not be required to report on them in 2025. This ensures that organisations maintaining consistent policies retain their validation status and score from the prior year, streamlining the reporting process.

- Transition from DEI to “Human Capital”

A number of GRESB indicators that previously assessed Diversity, Equity, and Inclusion (DEI) will now adopt a broader “Human Capital” approach. This shift reflects an expanded focus on workforce-related factors, including employee well-being, training, and DEI.

Alongside this, GRESB has removed the requirement for the gender ratio (measured in male and female only) to add up to 100%, allowing for the consideration of other gender identities for the first time.

- Revises evidence validation requirements

GRESB has updated the evidence validation requirements for a number of indicators, including those assessing climate risks and opportunities (RM6.1-RM6.4).

- Revised criteria for Standing Investments & asset eligibility

GRESB has updated its criteria for Standing Investments (i.e. operational assets), including additional clarification regarding joint ventures and specific criteria for the exclusion of dormant assets.

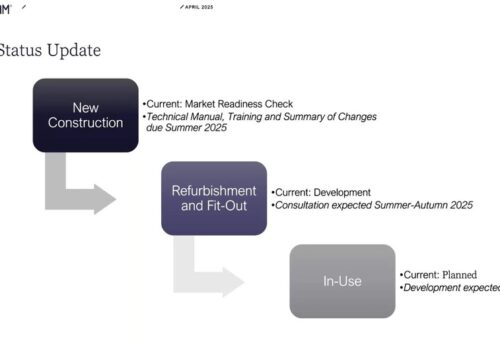

Additionally, GRESB has reinforced the eligibility of design projects to be reported under the Development Component, ensuring consistency in reporting practices.

- Updated unit consolidation guidance for multi-unit assets

For residential portfolios and financial assets consisting of multiple units, GRESB now requires separate reporting if unit consolidation leads to discrepancies between data availability periods and reported performance data.

- New energy efficiency scoring based on ASHRAE Standard 100:2024

GRESB will now assess energy efficiency performance using the updated ASHRAE Standard 100:2024, a globally recognised benchmark for building energy performance, in addition to Like-For-Like (LFL). This change emphasises the importance of energy-efficient operations and acknowledges that highly efficient assets cannot be expected to achieve consistent annual (i.e. LFL) reductions in energy consumption.

- More flexibility in estimating energy consumption

Previously, partially missing energy data could only be estimated for specific reasons. The new methodology allows partial estimation, regardless of the reason for the data being missing – provided the missing data does not exceed GRESB’s defined limits.

- Simplification of building certification requirements

GRESB has removed the requirement for building certification evidence to be submitted to the scheme before the end of the reporting year – a step back from new requirements introduced in 2024. Now, to be considered valid, certificates must only:

- Cover a performance year during or before the end of the reporting year.

- Have completed development (if design/construction/interior certification) during or before the end of the reporting year

- Have received certification before the 1st July GRESB deadline.

For the full list of changes, refer to Appendices 1 & 2 of the 2025 Reference Guide and our article on the 2024 changes.