- February 2, 2024

Important update! GRESB 2024 reference guide

Recent developments in real estate benchmarking! GRESB has just unveiled the 2024 Standards and Reference Guides, accompanied by essential documents like the Scoring Document and Asset Spreadsheet. Participants can now initiate their preparation for the upcoming GRESB portal launch on 1st April, with a completion window extending until 1st July for their 2024 assessments.

In recent years, GRESB has been diligent in sharing a high-level list of assessment changes within the preceding year, allowing participants ample time to adjust before the end of their reporting period, as per Theo Bibby’s blog article published in 2023. Our thorough examination of the new set of documents reveals noteworthy changes in 2024 compared to the 2023 assessment:

1️⃣ Evolution in evidence validation requirements: Aligned with an increased emphasis on climate-related risks and opportunities, GRESB has adjusted evidence requirements for indicators assessing physical and transition risk (i.e. RM6.1-RM6.4) from reporting-only evidence to validated evidence. Scoring for these indicators now depends on meeting GRESB’s evidence requirements.

2️⃣ Removal of evidence requirements: GRESB has eliminated the need to provide supporting evidence for two indicators within the Development Component (i.e. DEN1 and DWT1).

3️⃣ Merging of reporting characteristics indicators: Responding to the demand for more precise performance benchmarking, GRESB has merged indicators R1.1 and R1.2 into R1 and DR1.1 and DR1.2 into DR1. This combines portfolio composition with the location of assets.

4️⃣ Additional guidance: GRESB has added supplementary definitions to the reference guide to assist participants in interpreting certain indicators.

5️⃣ New building certification schemes: GRESB has expanded its accepted list of schemes to include new design/construction and operational building certifications. Additionally, a number of interior green building certification schemes are accepted for the first time.

6️⃣ Additional data points in the Asset Spreadsheet: In line with changes announced last year, GRESB has introduced new fields to the Asset Spreadsheet. This includes an allowance for reporting four additional energy ratings, building certification years and non-operational electricity consumption in the form of electricity used to charge EVs.

If you have any questions about the new standards or need support in preparing for your 2024 assessments, feel free to get in touch at info@esgsolutionsltd.com or +44 (0) 204 526 8272. Your success in navigating your real estate reporting is our priority, especially now that every one-point increase in GRESB scoring is associated with a 0.09% quarterly or 0.36% increase in annualized total returns for NCREIF Open Ended Diversified Core Equity (ODCE) Index funds.

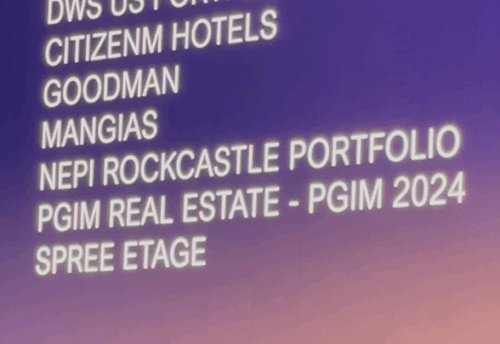

We are looking forward to sharing with you some amazing case studies about our long-term clients’ successful pathway to global sector leadership but also explain how we can help first-time participants embark seamlessly on their GRESB journey with us!