Generally speaking, taxonomy is the science of naming and classifying objects (typically organisms such as plants and animals) based on shared characteristics. The word comes from the Ancient Greek τάξις (taxis), “arrangement”, and νομία (nomia), “method”. Applied to the current sustainable finance context, taxonomy is a classification system which establishes a list of environmentally sustainable economic activities that play key roles in contributing to at least one environmental objective and don’t significant harm to the other objectives, while complying with minimum social standards.

Typically when our industry mentions the EU taxonomy, it refers to REGULATION (EU) 2020/852 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 18 June 2020, on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (SFDR), with the ultimate goal of avoiding – or at least reducing – greenwashing.

The EU taxonomy is part of the EU Action Plan on Sustainable Finance, established by the EU Technical Expert Group (EU TEG) on Sustainable Finance, and provides companies with suitable tools to reveal the measures they are taking about the environment, social impact and governance matters. It lays out requirements, numerous classifications and ways of reporting on sustainability related activities with the aim of demonstrating via a consistent legal framework how they strive for sustainability in their business (e.g. analysing their production model and its impact on the environment, establishing plans in order to carry out the necessary changes). This gives the organisations the opportunity to develop a robust and agile transition of their activities.

The EU taxonomy applies to two different parties 1) financial institutions that offer financial products on the European market and 2) non-financial companies that already have to submit a non-financial statement under Directive 2014/95/EU on the disclosure of non-financial and diversity information (the Non-Financial Reporting Directive, NFRD).

The EU taxonomy is not only aimed at the European Union or its Member States, but at all the actors involved in the financial markets. It directly affects the companies, who must adapt to the criteria outlined by the EU, but investors are also implicated, in particular those searching for opportunities for sustainable investment.

A common understanding is established via a classification system for sustainable activities. This is done by setting performance thresholds, outlined in the “Technical Screening Criteria”, to help parties identify environmentally friendly activities.

The EU taxonomy is definitely an important enabler to scale up sustainable investment and to implement the European Green Deal. It requires compliance with minimal social requirements and defines technical performance criteria (“substantial contributions”) against the following six environmental objectives:

(a) climate change mitigation (financial institutions need to adopt it by the end of 2021, non-financial companies throughout 2022);

(b) climate change adaptation (financial institutions need to adopt it by the end of 2021, non-financial companies throughout 2022);

(c) the sustainable use and protection of water and marine resources (financial institutions and non-financial companies need to adopt it by the end of 2022);

(d) the transition to a circular economy (financial institutions and non-financial companies need to adopt it by the end of 2022);

(e) pollution prevention and control (financial institutions and non-financial companies need to adopt it by the end of 2022);

(f) the protection and restoration of biodiversity and ecosystems (financial institutions and non-financial companies need to adopt it by the end of 2022).

Notably, by providing appropriate definitions to companies, investors and policymakers on which economic activities can be considered environmentally sustainable, it is expected to create security for investors, protect private investors from greenwashing, help companies to plan the transition, mitigate market fragmentation and eventually help shift investments where they are most needed.

For an economic activity to comply with the EU taxonomy three measures must be in place:

- Substantially contribute to at least one of the six environmental objectives, as defined in the technical screening criteria;

- Do no significant harm (DNSH) to any of the other five environmental criteria, as defined in the technical screening criteria/delegated acts per activity;

- Comply with minimum (social) standards such as the OECD Guidelines on Multinational Enterprises, the UN Guiding Principles on Business and Human Rights, Principles and rights of International Labour Organisation on Fundamental Principles and Rights at Work.

The EU Commission has prepared in early 2021 an IT tool that will facilitate the use of the taxonomy by allowing users to navigate easily through the taxonomy. For more information, please visit this website.

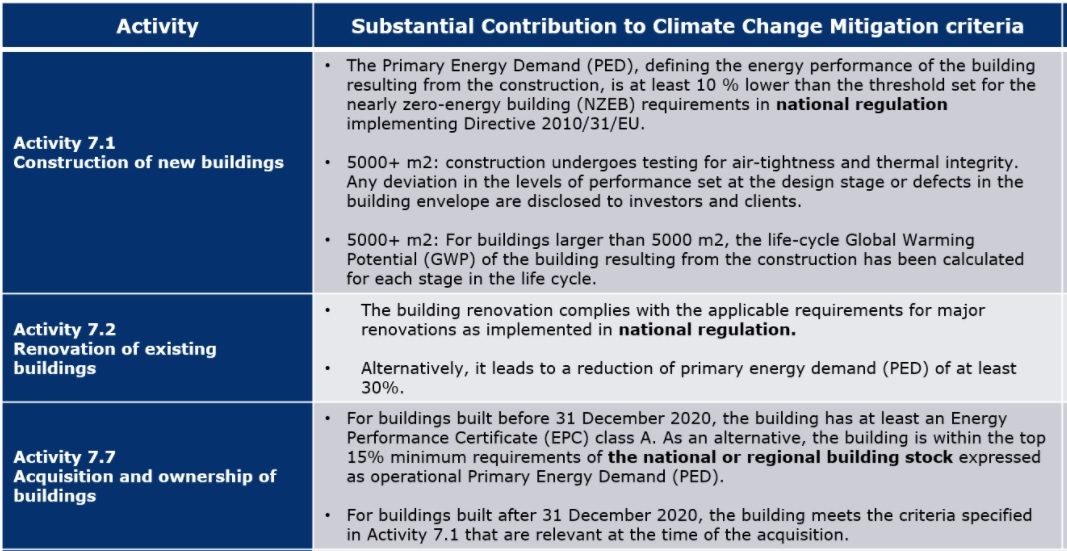

We have provided in the table below a typical approach for the real estate sector. Please note the reference to new buildings having to exceed NZEB performance by at least 10%.