- April 25, 2024

Why Mangia’s ESG strategy is ground-breaking

On 18th and 19th April 2024 Diligentia ETS hosted the second “Forum ESG 2030” in Rome and E.S.G. Solutions played a significant role at the event, as founding members of the association dating back to its establishment in December 2021.

To better understand the range of ESG topics covered in these two days in Italy and the impact of the results, we have summarised below the top-10 highlights from the various sessions:

- Discussion Paper “ESG nel rapporto impresa – banca” detailing the state of art of the relationship between banks and the industry, specifically enterprises.

- Position Paper “ESG nel rapporto impresa – filiera di fornitura responsabile“, focusing on responsible supply chains.

- Diligentia ETS – ENI deal to integrate the Open-Es ESG digital platform (endorsed by Unicredit and used by 18,552 companies in 99 countries across 66 industrial sectors) with the Get It Fair program.

- Announcement of the deal between IAF (International Accreditation Forum) and IESBA (International Ethics Standard Board for Accountants) to adopt IESBA’s Code of Ethics to certify programs (and hence bodies) whose scope is corporate sustainability disclosure.

- Joint research by Diligentia ETS e CUEIM (Consorzio Universitario di Economia industriale e Manageriale) about new competences required in this emerging and thriving industry.

- Launch of the public consultation about the Pdr (“Prassi di Riferimento”) UNI-Accredia-Diligentia about the assessment of the conformity of the corporate sustainability disclosure.

- Diligentia ETS joining the “Manifesto sulla parità di genere” promoted by the Winning Woman Institute about gender equality.

- Get It Fair announcement’s to add to its regulations the obligation for certification bodies (e.g. ICMQ) to adopt and operate in conformity with IESBA’s Code of Ethics i.e. exactly the same ethical standard that financial auditors need to comply with.

- Get It Fair ESG Rating and Reporting Assurance Scheme being added to the list of GRESB-approved ESG Assurance Standards from 2024.

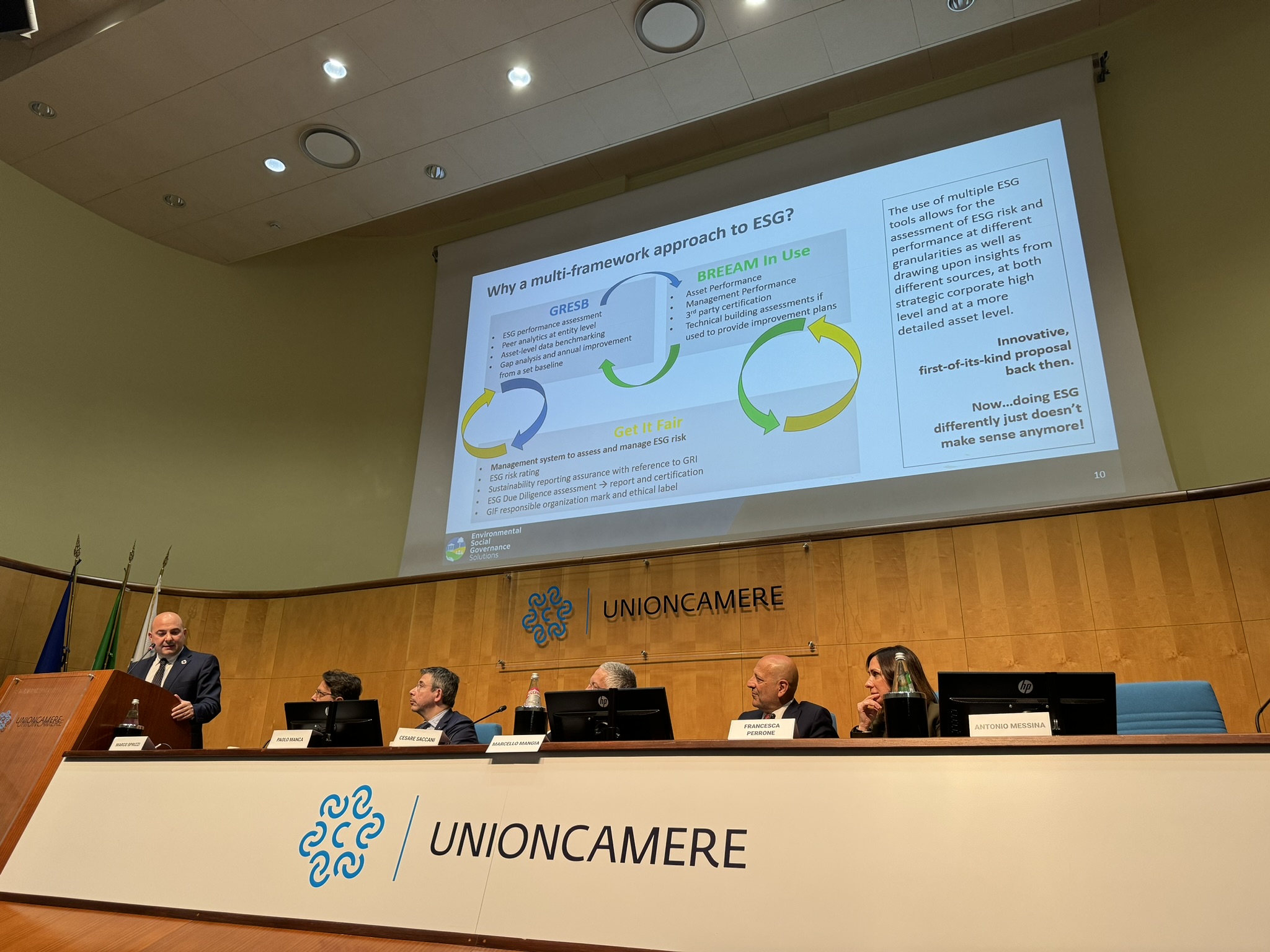

- The first successful case study of a major player in the hospitality industry (Mangia’s) to pass a Due Diligence process undertaken by an independent 3rd party with reference to international standards and to obtain an ESG risk rating as part of a multi-framework approach to the sustainability agenda. This Italian management company has embarked on a very ambitious journey which aims to scale up their current portfolio of 13 sea resorts and 2 city hotels with a strong focus on ESG and adopting some of the most renowned certification and benchmarking tools to assess, compare and disclose their sustainability credentials, such as BREEAM In Use and GRESB. The video is available on youtube here: https://www.youtube.com/live/UCnYrAY4_3c.

Keep reading if you would like to hear more details about this highly innovative approach…

Mangia’s President and E.S.G. Solutions’s Founder joined an engaged panel of high-profile keynote speakers including Unicredit Bank, Federalberghi and Expedia Group, who were very keen to hear how these all-important ESG topics could be applied to a real case study and generate added value across the whole value chain when implemented at all levels of the organisation.

- developing a cutting edge framework which constitutes the solid foundations of a compliant management system to assess, manage and mitigate ESG risk;

- allowing the organisation to pass a 3rd party due diligence process and obtain a trustworthy ESG rating which provides banks, insurances and stakeholders in general with confidence about the process adopted by the company to identify ESG-related risks and opportunities;

- setting up ESG policies, procedures and KPIs to track and monitor performances and to ensure regulatory compliance over the years;

- building ESG databases and clear, forward looking pathways for improvement;

- adding ESG objectives and targets to employees and managers, which will drive change and maximise impacts;

- improving ESG culture across the organisation and ensuring that appropriate training to all staff and managers is provided;

- ensuring comprehensive integration and implementing improvement plans across all business units;

- getting senior decision makers within the organisation to endorse sustainability action plans at both entity- and asset- levels.

-

The set up of an integrated management system based on the Get It Fair (GIF) framework, which included – among others – tasks such as drafting company policies, undertaking stakeholder engagement, completing the materiality assessment and collecting ESG data at both corporate and asset level. As said earlier, the project’s objective was to obtain a 3rd party ESG risk rating and the assurance of their first sustainability report with reference to the latest GRI standards, plus the right to be listed among the organisations that can legitimately claim to be a “GIF Responsible Organization“.

-

The certification of its real estate assets using the BREEAM In Use International scheme v.6 for existing buildings.

- The voluntary disclosure of Aeroviaggi’s Direct Investments using GRESB for peer benchmarking.

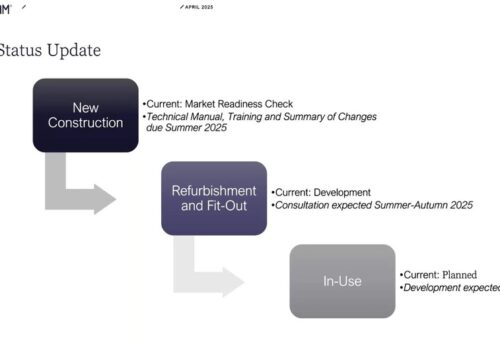

Our presentation anticipated BRE (Building Research Establishment)’s release of its comprehensive “BREEAM In Use & GRESB Mapping Resource” document, which outlines alignment between the 2024 GRESB Real Estate Standard and Reference Guide and BREEAM In Use Version 6 criteria. The resource is a key tool helping building owners, operators and consultants best identify overlap between:

- the International and U.S. versions of BREEAM In Use (Commercial and Residential), the world’s leading science-backed green building assessment for existing buildings, with 600,000+ certificates issued in more than 89 countries, and

- 2024 indicators from GRESB, the premier global benchmark for sustainable building performance.

Evaluation of the 2024 standards revealed that 33 GRESB indicators are addressed by BREEAM In Use, translating to over 100 touchpoints across BREEAM In Use assessments and exemplifying how BREEAM can be leveraged to guide the collection of science-driven performance data to support improved reporting, regulatory compliance and broader benchmarking against corporate sustainability goals.

In this first-of-its-kind case study E.S.G. Solutions added an extra layer of ESG intelligence by comparing the GIF framework, which led to a 3rd party validated claim of ESG credentials, assurance of corporate sustainability reporting and ESG risk rating, with both BREEAM In Use and GRESB.

If you would like to hear more about these three frameworks, how they have been applied to this case study and how they strengthen each other when used in combination, don’t hesitate to be in touch with us at info@esgsolutionsltd.com or feel free to reach out to our linkedin webpage here.