GRESB case study:

taking an Italian client to GLOBAL leadership

The Client (COIMA SGR S.p.A.) is a leading platform in the investment, development and management of real estate assets on behalf of institutional investors, with over €10 billion EUR of stabilised assets under management (AUM). It helps owners, investors and occupiers with realising direct and indirect investments by producing enhanced assets through its development and renovation projects with a suite of integrated services including, sourcing, planning, funding, managing and valuing and selling properties.

In 2019, the Client participated in the GRESB Real Estate Assessment for the first time, acknowledging the increasing importance of ESG issues. As such, the Client became one of the first Italian participants in the Assessment, achieving a score of 60/100 and placing 54th out of 64 entities in their benchmark group.

In the 2020 Assessment, the Client improved its performance, achieving scores of 64/100 in the Standing Investments Benchmark and 82/100 in the Development Benchmark. With aims to achieve further improvements in future years, the Client sought in-depth technical support from E.S.G. Solutions.

E.S.G. Solutions began supporting the Client in 2021, when we signed a long-term contract allowing us to put in place a process of continuous improvement over a number of years. This included a recurring cycle of information gathering, results analysis, action plan creation and on-going implementation.

Process 1: Information gathering

Each reporting cycle, E.S.G. Solutions liaised with the different areas of the Client’s organisation to gather all the information, responses, evidence and data required to complete the Assessment, providing expert advice and guidance on the requirements of each indicator.

Process 2: Gap analysis

Using the results from the most recent GRESB Assessment and information gathering process, E.S.G. Solutions would conduct a gap analysis that compared the performance of the Client against both the assessment requirements and performance of the benchmark group to identify the most material areas of improvement. This analysis was repeated after each reporting cycle.

Process 3: Action plans

E.S.G. Solutions created an action plan divided into short-term and long-term actions that would improve GRESB scoring and ESG performance. This was updated each year following the release of the latest GRESB guidance and results of the gap analysis.

Process 4: Implementation

Throughout each reporting cycle, E.S.G. Solutions supported with the implementation of the action plan, analysing and uploading all of the information to the GRESB Portal, and providing other support as required.

To facilitate improvements in GRESB scoring and broader ESG performance, E.S.G. Solutions provided additional support for several indicators within the GRESB Assessment. This additional support spanned all aspects of the Assessment, ranging from management practices to asset performance:

Asset-level data analysis

Review and alignment of asset-level data to improve reporting granularity and maximise scoring against the GRESB methodology

EMS creation

Creation of an Environmental Management System (EMS) aligned to the ISO 14001 standard

ESG reporting

Disclosure aligned to the INREV standards for environmental data reporting

Evidence creation

Creation of evidence to capture the ESG practices in place across the Client’s organisation and assets.

Technical building assessments

Energy, water and waste audits of the Client’s assets to assess performance and identify efficiency opportunities

Third-party reviews

External reviews of energy, water, GHG and waste data, in conjunction with third-party assurance and GRI alignment

Acknowledging that ESG-alignment is an on-going process and not something that can be achieved within a single reporting cycle, the use of a long-term commitment allowed us not only to be more competitive but also to create and implement a successful plan that added real value and provided a tangible impact to COIMA’s operations going forward.

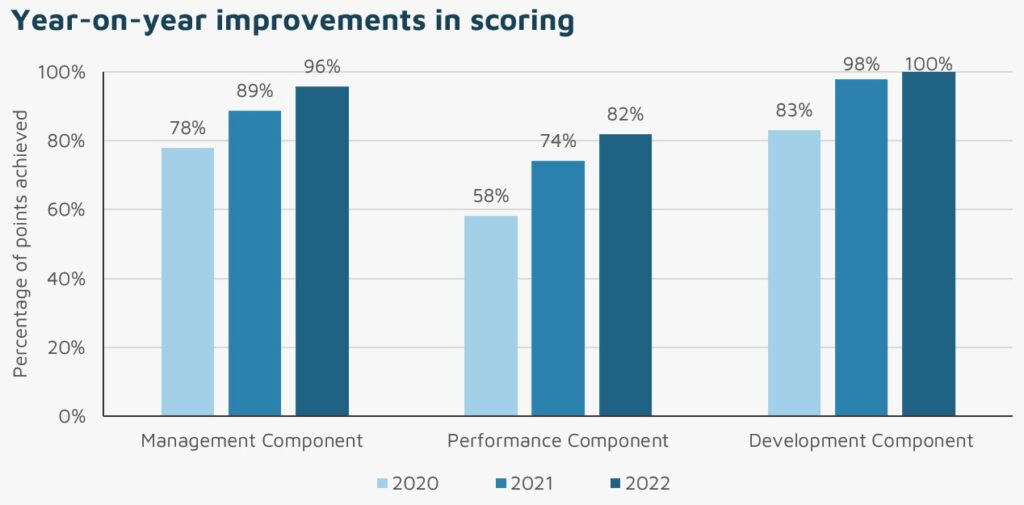

Our wide range of expertise allowed us to create an action plan that was fully tailored to the needs of the Client, as well as implementing a variety of different measures that could improve the ESG performance and GRESB scoring over time. With support from E.S.G. Solutions, the Client achieved year-on-year improvements across all three components of the Real Estate Assessment and the results speak for themselves.

In 2022, they achieve Global Sector Leaders Status for the Development Benchmark as recognition for achieving the highest score within their sector.

E.S.G. Solutions continues to work with the Client for the 2023 Assessment, where we look to maintain the leadership status during a year of significant change to the Assessment and facilitate further improvements in the Performance Component.

“We are proud of this important result which confirms our commitment in the integration of environmental, social and good governance aspects and strengthens our positioning both on the Italian and European level among the real estate investment funds managers that are most attentive to ESG issues”

Stefano Corbella, Sustainability Officer

-

GRESB advisory

E.S.G. Solutions is an approved GRESB Partner, supporting leading global investment management platforms and business builders in logistics, real estate, infrastructure, finance and related technologies, who develop and/or manage assets, to unlock integrated value for their Clients and investors and improve their sustainability credentials over time through peers benchmarking. The project that we have chosen to show here is the iconic Unicredit Tower in Piazza Gae Aulenti, part of COIMA's Porta Nuova Garibaldi (PNG) fund featuring 200,000+ square metres of prime office and retail AUM in the heart of Milan (Italy) with GAVs exceeding €1 million. As COIMA's ESG technical advisors we are proud to provide the SGR with sustainability services which add real value to a number of their funds, including PNG and COIMA Opportunity Fund II. -

ESG data management and reporting

We are assisting private Clients, global groups and local authorities with their ESG data collation, verification of GHG data including Scopes 1, 2 and 3, consolidating and harmonising their corporate reporting, analysing trends and supporting their communication strategy to stakeholders. The project that we would like to mention here is the technical support that we are providing to GLP, a leading global investment manager and business builder in logistics, data infrastructure, renewable energy and related technologies, to create - in conjunction with their IT solution provider - an advanced ESG Portal which meets minimum requirements in terms of accuracy, completeness and data quality. Founded in 2009, GLP aims at consistently capture and manage ESG data to support their decision-makers to make more informed decisions and allow the disclosure of ESG data and the regular review of ESG performance at each level. Their new data strategy aims to drive ESG insights for material issues and align with their ESG Policy, with the ultimate objectives to enable investment decision-making to be more evidence-driven, provide a consistent view for all assets and allow comparability, thereby building an information edge, improving knowledge management and fostering transparency. -

Asset-level ESG audit reviews

We are designing and delivering rolling programmes of bespoke reviews of the sustainability and ESG credentials of real assets, on behalf of Clients who need fully-customised assessments of their portfolios to build a baseline and improve them over time without the need to go through full certification. -

BREEAM In-Use certification

We are evaluating the sustainability credentials of existing residential and non-domestic assets for Clients who are interested in a value-for-money third party certification which increases property value and recognition, helps improve well-being, supports a circular economy, bridges the performance gap and leads the way to Net-Zero Carbon. -

Net-Zero Carbon strategy and implementation

We are developing for a building complex and several real estate domestic and non-domestic portfolios a strategy to become Net-Zero Carbon (NZC) within the next few decades (Scope 1&2 operational carbon only). The services includes the preliminary analysis of ESG data, a step-by-step pathway to NZC and the disclosure tasks involved. -

ESOS mandatory energy audits

We are helping large enterprises, who exceed 250 staff or €50 million turnover and €43 million total balance sheet, comply with their Article 8 Energy Efficiency Directive obligations in each of the 27 EU Member States plus the UK, uncovering carbon saving opportunities and ensuring that compliance is comfortably met by the deadlines. -

Streamlined Energy and Carbon Reporting

We are helping the finance directors of UK quoted companies and large unquoted firms with 250+ staff and/or exceeding £36 million of turnover and/or £18 million of balance sheet total prepare energy and carbon information for their Directors' Reports due nine months after the end of their financial year. -

EPC and MEES advisory

With regulations tightening in the UK around the Minimum Energy Efficiency Standard (MEES), landlords and asset managers who cannot lawfully rent out their properties are asking us for technical and strategic support with those Energy Performance Certificates (EPCs) whose Asset Rating is below expectations, before they become stranded assets. -

Display Energy Certification (DEC)

DECs promote the improvement of the energy performance of buildings and form part of the implementation in England and Wales of the European Directives 2002/91/EC and 2010/31/EU on the energy performance of buildings. The purpose of a DEC is to raise public awareness of energy use and to inform visitors to public buildings about the energy use of a building. DECs provide an operational energy rating of the building from A to G and are based on the actual amount of metered energy used by the building over the last 12 months within the validity period of the DEC. An affected organisation must display a DEC in a prominent place clearly visible to the public (i.e. it should be no smaller than A3 in size) and have in its possession or control a valid advisory report, containing recommendations for improving the energy performance of the building. The project that we have chosen to show here is the DEC commissioned by the Royal Academy of Arts (RA), a British institution with over 250 years which champions art and artists, home to Britain’s longest established art school: the RA Schools. Every year since 1768 the RA has held an annual Summer Exhibition, the largest open-submission art exhibition in the world, with a collection of art and architecture in free displays throughout RA's headquarters on Piccadilly, Burlington House and Gardens, which have been certified by E.S.G. Solutions in 2021. The 16,000+ square metres building complex is the product of a major redevelopment that links the 17th-century mansion on Piccadilly with a grand 19th-century former university building designed by Sir David Chipperfield.