First things first, let’s set the scene: it has been recognised at global level that climate change presents financial risk to the global economy and financial markets need clear, comprehensive, high-quality information on the impacts of climate change.

This includes the risks and opportunities presented by rising temperatures, climate-related policy and emerging technologies in our changing world.

The Financial Stability Board created the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information in order to:

- more effectively evaluate climate-related risks to a company, its suppliers and competitors (risk assessment);

- make better-informed decisions on where and when to allocate a company’s capital (capital allocation);

- better evaluate risks and exposures over the short, medium and long term (strategic planning).

The TCFD has then developed the framework below to help public companies and other organizations more effectively disclose climate-related risks and opportunities through their existing reporting processes:

- GOVERNANCE: Disclose the organization’s governance around climate-related risks and opportunities.

- STRATEGY: Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning where such information is material.

- RISK MANAGEMENT: Disclose how the organization identifies, assesses, and manages climate-related risks.

- METRICS & TARGETS: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

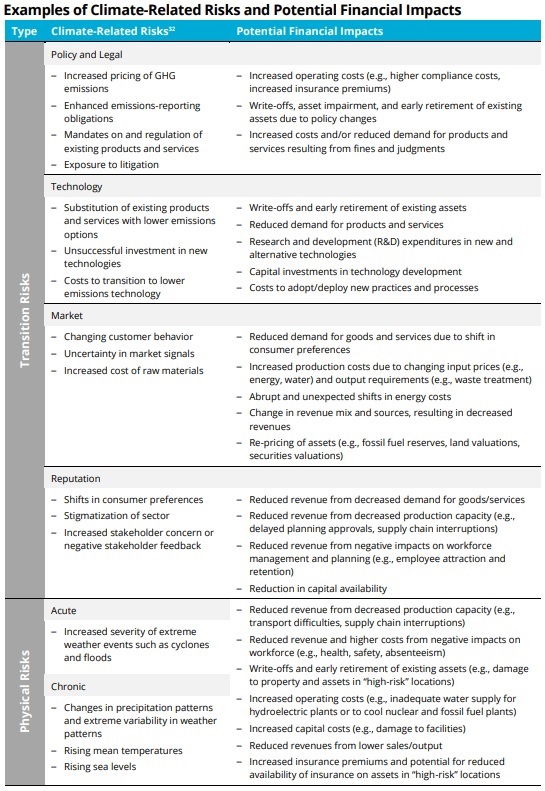

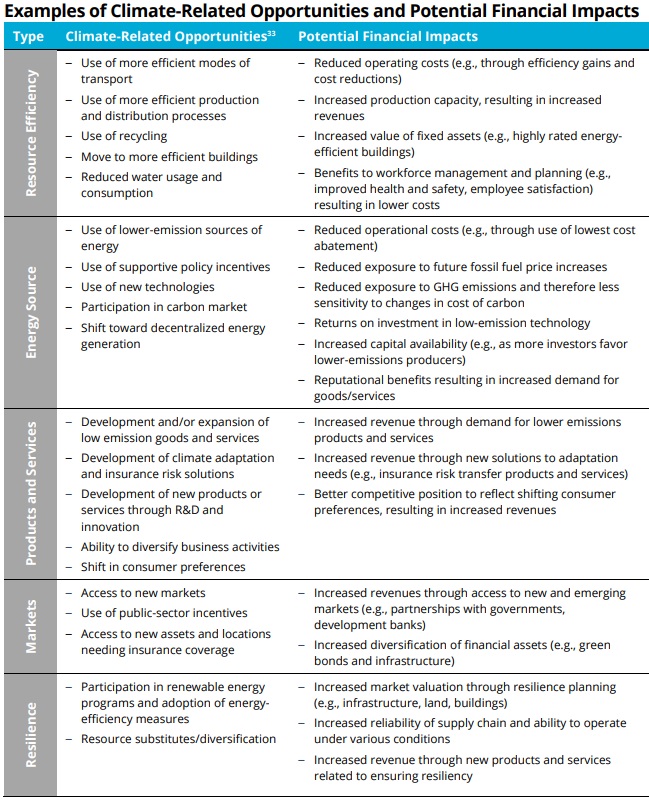

The TCFD also defined categories for climate-related risks and climate-related opportunities, with recommendations that serve to encourage organisations to evaluate and disclose, as part of their annual financial filing preparation and reporting processes, the climate-related risks and opportunities that are most pertinent to their business activities.

Risks

With regard to climate-related risks, the TCFD divided them into two major categories: risks related to the transition to a lower-carbon economy and risks related to the physical impacts of climate change.

Transition Risks

Transitioning to a lower-carbon economy may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, and focus of these changes, transition risks may pose varying levels of financial and reputational risk to organizations.

- Policy and Legal Risks. Policy actions around climate change continue to evolve. Their objectives generally fall into two categories i.e. policy actions that attempt to constrain actions that contribute to the adverse effects of climate change or policy actions that seek to promote adaptation to climate change. Some examples include implementing carbon-pricing mechanisms to reduce GHG emissions, shifting energy use toward lower emission sources, adopting energy-efficiency solutions, encouraging greater water efficiency measures, and promoting more sustainable land-use practices. The risk associated with and financial impact of policy changes depend on the nature and timing of the policy change. Another important risk is litigation or legal risk. Recent years have seen an increase in climate-related litigation claims being brought before the courts by property owners, municipalities, states, insurers, shareholders, and public interest organizations. Reasons for such litigation include the failure of organizations to mitigate impacts of climate change, failure to adapt to climate change, and the insufficiency of disclosure around material financial risks. As the value of loss and damage arising from climate change grows, litigation risk is also likely to increase.

- Technology Risk. Technological improvements or innovations that support the transition to a lower-carbon, energy efficient economic system can have a significant impact on organizations. For example, the development and use of emerging technologies such as renewable energy, battery storage, energy efficiency, and carbon capture and storage will affect the competitiveness of certain organisations, their production and distribution costs, and ultimately the demand for their products and services from end users. To the extent that new technology displaces old systems and disrupts some parts of the existing economic system, winners and losers will emerge from this “creative destruction” process. The timing of technology development and deployment, however, is a key uncertainty in assessing technology risk.

- Market Risk. While the ways in which markets could be affected by climate change are varied and complex, one of the major ways is through shifts in supply and demand for certain commodities, products, and services as climate-related risks and opportunities are increasingly taken into account.

- Reputation Risk. Climate change has been identified as a potential source of reputational risk tied to changing customer or community perceptions of an organization’s contribution to or detraction from the transition to a lower-carbon economy.

Physical Risks

Physical risks resulting from climate change can be event driven (acute) or longer-term shifts (chronic) in climate patterns. Physical risks may have financial implications for organizations, such as direct damage to assets and indirect impacts from supply chain disruption. Organisations’ financial performance may also be affected by changes in water availability, sourcing, and quality; food security; and extreme temperature changes affecting organizations’ premises, operations, supply chain, transport needs, and employee safety.

- Acute Risk. Acute physical risks refer to those that are event-driven, including increased severity of extreme weather events, such as cyclones, hurricanes, or floods.

- Chronic Risk. Chronic physical risks refer to longer-term shifts in climate patterns (e.g., sustained higher temperatures) that may cause sea level rise or chronic heat waves.

Opportunities

With regard to climate-related opportunities, efforts to mitigate and adapt to climate change also produce opportunities for organisations, for example, through resource efficiency and cost savings, the adoption of low-emission energy sources, the development of new products and services, access to new markets, and building resilience along the supply chain. Climate-related opportunities will vary depending on the region, market, and industry in which an organization operates. The TCFD identified several areas of opportunity, as described below.

Resource Efficiency

There is growing evidence and examples of organizations that have successfully reduced operating costs by improving efficiency across their production and distribution processes, buildings, machinery/appliances, and transport/mobility—in particular in relation to energy efficiency but also including broader materials, water, and waste management. Such actions can result in direct cost savings to organisations’ operations over the medium to long term and contribute to the global efforts to curb emissions. Innovation in technology is assisting this transition; such innovation includes developing efficient heating solutions and circular economy solutions, making advances in LED lighting technology and industrial motor technology, retrofitting buildings, employing geothermal power, offering water usage and treatment solutions, and developing electric vehicles.

Energy Source

According to the International Energy Agency (IEA), to meet global emission-reduction goals, countries will need to transition a major percentage of their energy generation to low emission alternatives such as wind, solar, wave, tidal, hydro, geothermal, nuclear, biofuels, and carbon capture and storage. For the fifth year in a row, investments in renewable energy capacity have exceeded investments in fossil fuel generation. The trend toward decentralized clean energy sources, rapidly declining costs, improved storage capabilities, and subsequent global adoption of these technologies are significant. Organizations that shift their energy usage toward low emission energy sources could potentially save on annual energy costs.

Products and Services

Organizations that innovate and develop new low-emission products and services may improve their competitive position and capitalize on shifting consumer and producer preferences. Some examples include consumer goods and services that place greater emphasis on a product’s carbon footprint in its marketing and labelling (e.g., travel, food, beverage and consumer staples, mobility, printing, fashion, and recycling services) and producer goods that place emphasis on reducing emissions (e.g., adoption of energy-efficiency measures along the supply chain).

Markets

Organizations that pro-actively seek opportunities in new markets or types of assets may be able to diversify their activities and better position themselves for the transition to a lower-carbon economy. In particular, opportunities exist for organizations to access new markets through collaborating with governments, development banks, small-scale local entrepreneurs, and community groups in developed and developing countries as they work to shift to a lower-carbon economy. New opportunities can also be captured through underwriting or financing green bonds and infrastructure (e.g., low-emission energy production, energy efficiency, grid connectivity, or transport networks).

Resilience

The concept of climate resilience involves organizations developing adaptive capacity to respond to climate change to better manage the associated risks and seize opportunities, including the ability to respond to transition risks and physical risks. Opportunities include improving efficiency, designing new production processes, and developing new products. Opportunities related to resilience may be especially relevant for organizations with long-lived fixed assets or extensive supply or distribution networks; those that depend critically on utility and infrastructure networks or natural resources in their value chain; and those that may require longer-term financing and investment.

Financial impacts

In order to make more informed financial decisions, investors, lenders and insurance underwriters need to understand how climate-related risks and opportunities are likely to impact an organisation’s future financial position as reflected in its income statement, cash flow statement, and balance sheet. To assist organizations in identifying climate-related issues and their impacts, the TCFD developed the following Tables, which provides examples of climate-related risks and their potential financial impacts and examples of climate-related opportunities and their potential financial impacts. They can be found on the final report issued in June 2017 “Recommendations of the Task Force on Climate related Financial Disclosures”.

The TCFD believes that organisations should use scenario analysis to assess potential business, strategic, and financial implications of climate-related risks and opportunities and disclose those, as appropriate, in their annual financial filings. Scenario analysis is a process for identifying and assessing the potential implications of a range of plausible future states under conditions of uncertainty. Scenarios are hypothetical constructs and not designed to deliver precise outcomes or forecasts. Instead, scenarios provide a way for organizations to consider how the future might look if certain trends continue or certain conditions are met. In the case of climate change, for example, scenarios allow an organization to explore and develop an understanding of how various combinations of climate-related risks, both transition and physical risks, may affect its businesses, strategies, and financial performance over time.

Scenario analysis can be:

- qualitative, relying on descriptive, written narratives;

- quantitative, relying on numerical data and models;

- some combination of both.

Qualitative scenario analysis explores relationships and trends for which little or no numerical data is available, while quantitative scenario analysis can be used to assess measurable trends and relationships using models and other analytical techniques. Both rely on scenarios that are internally consistent, logical, and based on explicit assumptions and constraints that result in plausible future development paths.

As the effects of climate change on specific sectors, industries, and individual organizations are highly variable, it is important that all organisations consider applying a basic level of scenario analysis in their strategic planning and risk management processes. Organizations more significantly affected by transition risk (e.g., fossil fuel-based industries, energy-intensive manufacturers, and transportation activities) and/or physical risk (e.g., agriculture, transportation and building infrastructure, insurance, and tourism) should consider a more in-depth application of scenario analysis.

- Exposure to Transition Risks. Transition risk scenarios are particularly relevant for resource-intensive organisations with high GHG emissions within their value chains, where policy actions, technology, or market changes aimed at emissions reductions, energy efficiency, subsidies or taxes, or other constraints or incentives may have a particularly direct effect. A key type of transition risk scenario is a so-called 2°C scenario, which lays out a pathway and an emissions trajectory consistent with holding the increase in the global average temperature to 2°C above pre-industrial levels. In December 2015, nearly 200 governments agreed to strengthen the global response to the threat of climate change by “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels,” referred to as the Paris Agreement. As a result, a 2°C scenario provides a common reference point that is generally aligned with the objectives of the Paris Agreement and will support investors’ evaluation of the potential magnitude and timing of transition-related implications for individual organizations; across different organizations within a sector; and across different sectors.

- Exposure to Physical Risks. A wide range of organizations are exposed to climate-related physical risks. Physical risk scenarios generally identify extreme weather threats of moderate or higher risk before 2030 and a larger number and range of physical threats between 2030 and 2050. Although most climate models deliver scenario results for physical impacts beyond 2050, organizations typically focus on the consequences of physical risk scenarios over shorter time frames that reflect the lifetimes of their respective assets or liabilities, which vary across sectors and organisations. Physical climate-related scenarios are particularly relevant for organizations exposed to acute or chronic climate change, such as those with:

- long-lived, fixed assets;

- locations or operations in climate-sensitive regions (e.g., coastal and flood zones);

- reliance on availability of water; and

- value chains exposed to the above.

For more information about the TCFD please visit their official website.