Streamlined Energy and Carbon Reporting (SECR)

The Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018 (“the 2018 Regulations”) implement the government’s policy on Streamlined Energy and Carbon Reporting (SECR) and these new legal obligations came into force on 1st April 2019.

The Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013 introduced changes to require quoted companies to report their annual emissions and an intensity ratio in their Directors’ Report. The 2018 Regulations bring in additional disclosure requirements for quoted companies. The 2018 Regulations also introduce requirements for large unquoted companies and limited liability partnerships to disclose their annual energy use and greenhouse gas emissions, and related information.

The legislation affects:

- quoted companies;

- large unquoted companies (including charitable companies);

- large Limited Liability Partnerships (LLPs).

Remember, you, or part of your organisation, may fall within the scope of SECR even if undertaking public, or not for profit activities as registered companies or companies/LLPs owned by universities, academies or NHS Trusts. You are however not however required to report under the SECR framework at an organisational level if your organisation is defined as a public body, although you may still have other reporting requirements such as under the Greening Government Commitments.

The government encourages all private sector organisations in the UK which are not in scope of the legislation to report similarly, although this remains voluntary.

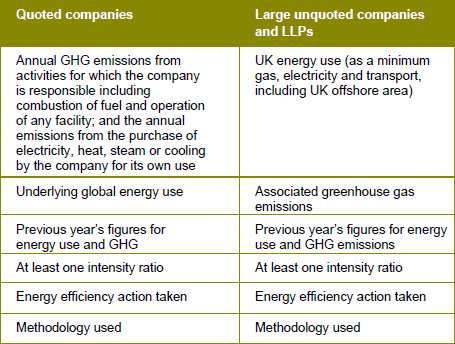

Under changes introduced by the 2018 Regulations, large unquoted companies and large LLPs are obliged to report their UK energy use and associated greenhouse gas emissions as a minimum relating to gas, electricity and transport fuel, as well as an intensity ratio and information relating to energy efficiency action, through their annual reports. Quoted companies of all sizes continue to be required to report their global greenhouse gas (GHG) emissions and an intensity ratio through their annual reports. Additionally, they are now required to report their total global energy use and information relating to energy efficiency action alongside the methodology used to calculate the new and existing disclosure requirements.

The new mandatory reporting requirements imposed by the 2018 Regulations are designed to:

- Increase awareness of energy costs within large and quoted organisations, including enhanced visibility to key decision makers;

- Create more of a level playing field among large organisations, in terms of energy and emissions reporting;

- Ensure administrative burdens associated with energy and emissions reporting are proportionate and broadly aligned to the existing energy reporting requirements and the business reporting framework;

- Provide organisations in scope with the right data to inform adoption of energy efficiency measures and opportunities to reduce their impact on climate change; and

- Provide greater transparency for investors, and other stakeholders, on business energy efficiency and low carbon readiness.

Although businesses should make use of their normal accounting and environmental management systems to regularise the collection of energy use information throughout the year, additions or changes to existing systems or processes may be required to take account of the new disclosure requirements.

While SECR reporting requirements cover emissions and energy information for the current and previous financial year, organisations may also wish to voluntarily set forward-looking science-based emissions reduction targets. Organisations seeking to report on forward-looking financial risks and opportunities arising from climate change should consider reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD has developed a globally recognised framework for making climate-related financial disclosures which the UK Government formally endorsed in September 2017.

Quoted companies

Under changes introduced by the 2013 and 2018 Regulations, quoted companies of any size that are required to prepare a Directors’ Report under Part 15 of the Companies Act 2006, are required to disclose information relating to their energy use and GHG emissions. Quoted companies in this respect are those whose equity share capital is officially listed on the main market of the London Stock Exchange; or is officially listed in an European Economic Area State; or is admitted to dealing on either the New York Stock Exchange or NASDAQ.

Quoted companies within the scope of the legislation must continue as a minimum to disclose in their Directors’ Report their:

- Annual global emissions from activities for which that company is responsible including the combustion of fuel and the operation of any facility; together with the annual emissions from the purchase of electricity, heat, steam or cooling by the company for its own use. This is also referred to as Global GHG Protocol Scope 1 and Scope 2 emissions.

- At least one intensity ratio.

- Previous year’s figures for energy use and GHG emissions (except in the first year).

- Methodologies used in calculation of disclosures.

Additionally for financial years that start on, or after, 1st April 2019, quoted companies must also report:

- Underlying global energy use that is used to calculate GHG emissions, including previous year’s figure.

- Information about energy efficiency action taken in the organisation’s financial year.

For financial years starting on or after 1st April 2019, quoted companies also need to state what proportion of their energy consumption and their emissions related to emissions and energy consumption in the UK (including offshore area).

Large unquoted companies and large limited liability partnerships

Under changes made by the 2018 Regulations, unquoted companies incorporated in the UK which are required to prepare a Directors’ Report under Part 15 of the Companies Act 2006, and which are “large” (see below) are required to prepare and file energy and carbon information in their Directors’ Reports. This applies to both registered companies and to unregistered companies which are required to prepare company accounts and reports. Under the 2018 Regulations, LLPs which are “large” are also required to prepare and file energy and carbon information in their accounts and reports (in a new ‘Energy and Carbon Report’). The definition of “large” is the same as applies in the existing framework for annual accounts and reports, based on sections 465 and 466 of the Companies Act 2006. The qualifying conditions are met by a company or LLP in a year in which it satisfies two or more of the following three requirements:

- Turnover £36 million or more

- Balance sheet total £18 million or more

- Number of employees 250 or more

Please note that the definition of “large” according to SECR differs from the one applicable to ESOS i.e. a company which EITHER employs 250 staff OR exceeds both €50 million (turnover) and €43 million (balance sheet total).

Unquoted companies and Limited Liability Partnerships in scope of the legislation will be required to disclose energy and carbon information in their accounts and reports, including:

- UK energy use (to include as a minimum purchased electricity, gas and transport).

- Associated greenhouse gas emissions.

- At least one intensity ratio.

- Previous year’s figures for energy use and GHG emissions.

- Information about energy efficiency action taken in the organisation’s financial year.

- Methodologies used in calculation of disclosures.

Additionally, if you are an offshore undertaking (i.e. if your activities consist wholly or mainly of offshore activities as defined in the 2018 Regulations) you must disclose your emissions and energy use for the UK and the offshore area.

Group reporting

If you are reporting at group level, for a financial year for which you are required to prepare a group Directors’ Report, when making your energy and carbon disclosures, you must take into account not only your own information, but also the information of any subsidiaries included in the consolidation which are quoted companies, unquoted companies or LLPs. However, you have the option to exclude from your report any energy and carbon information relating to a subsidiary which the subsidiary would not itself be obliged to include if reporting on its own account. The same applies to LLPs required to prepare a group Energy and Carbon Report. If you are reporting at subsidiary level, for a financial year for which your parent company (or parent LLP) is preparing a group relevant Report (i.e. a group Directors’ Report or a group Energy and Carbon Report), you might not be obliged to include your energy and carbon information in your own accounts and reports. A subsidiary is not obliged to report their energy and carbon information if:

- they are a “subsidiary undertaking” at the end of the relevant financial year;

- they are included in the group Report (whether a group Directors’ Report or a group Energy and Carbon Report) of a “parent undertaking”;

- that group Report is prepared for a financial year of the parent that ends at the same time as, or before the end of, the subsidiary’s financial year; and

- The group Report complies with the relevant obligations on the parent to report energy and carbon information for themselves and their subsidiaries; but this provision does not apply where the group Report relies on the seriously prejudicial option.

Again, please note that this is different to the approach taken under ESOS, where a smaller subsidiary of a parent company is not exempt, even where on its own, it would not meet ESOS eligibility criteria.

A corporate group is defined in the Companies Act 2006, and sections 1158 to 1162 of that Act explain how to identify if an undertaking is a parent to, or subsidiary of, another undertaking. You may wish to speak to your Finance Director in order to establish your organisation’s existing obligations relating to group reporting.

Low energy users

Where an organisation is a low energy user it is not required to make the detailed disclosures of energy and carbon information referred to above. Instead, such an organisation is required to state, in its relevant report, that its energy and carbon information is not disclosed for that reason. The following qualify as low energy users:

- A quoted company preparing a Directors’ Report which has consumed 40 MWh or less during the period in respect of which the report is prepared. If the quoted company is preparing a group Directors’ Report, the assessment is of the energy consumption of the parent and its subsidiaries which are included in the consolidation and are quoted companies, unquoted companies or LLPs.

- Unquoted companies or LLPs preparing a Directors’ Report or Energy and Carbon Report which have consumed 40 MWh or less in the UK, including offshore area, during the period in respect of which the report is prepared. If the company or LLP is preparing a group Report, the assessment is of the energy consumption of that parent and its subsidiaries.

Comply or explain

The legislation permits that certain information may be excluded:

- When the directors or members consider the disclosure of the energy and carbon information would be seriously prejudicial to the interests of the organisation. The relevant report must state that the energy and carbon information is not disclosed for that reason. Businesses are encouraged to rely on this only in exceptional circumstances, such as specific sensitivities arising from restructuring or acquisitions by an organisation in the run up to producing the relevant report, or when there are exceptional commercial sensitivity considerations. Such situations are deemed to be very rare and may be questioned by the Financial Reporting Council (FRC).

- Where the energy and carbon information is not practical to obtain. The relevant Report must still state what energy and carbon information is not included and why. That means, should you be in the situation where it is not practical for you to obtain all required energy and carbon information, you must state what is omitted and explain why in the relevant report. It is recommended that you set out the level of materiality and the steps you are taking to acquire the information.

For financial years that start on or after 1st April 2019, with the exception of the first mandatory reporting year, businesses in scope must also state the emissions, energy use and intensity ratio disclosures made in their previous year’s relevant Report. For financial years that start earlier than 1st April 2019, quoted companies are already required to disclose the emissions and intensity ratio disclosures if disclosed in the previous year’s relevant Report. Organisations are encouraged to disclose the previous five years’ performance, where possible, to show a longer-term trajectory and trigger discussions around changes in energy use or emissions over time.

The obligation is to disclose annual figures for emissions and energy use. If the annual period used is not the same as the financial year covered by the relevant Report, this must be made clear in the Report. If actions have been taken to improve the businesses’ energy efficiency during the financial year covered by the relevant Report, a description of the principal energy efficiency actions taken should be disclosed in the relevant Report. The actions should not relate to periods outside the organisations’ financial year. Organisations are encouraged that all information is aligned to financial years, to aid comparability and consistency of information across reports and organisations.

Companies in scope of the legislation will need to include their energy and carbon information in their Directors’ Report as part of their annual filing obligations. The 2018 Regulations impose requirements on large LLPs to prepare an equivalent report to the Directors’ Report (the “Energy and Carbon Report”) for each financial year including their energy and carbon information. The Energy and Carbon Report must be approved by the LLP’s members and signed on behalf of the LLP by a designated member. The Energy and Carbon Report also needs to identify each of its members during the financial year. LLPs may wish to consider whether they can comply with the latter requirement by referring to the online list published by Companies House, if one is available. In the case of charitable companies, the reporting should be in the combined Directors’ and Trustees’ Annual Report.

Where energy usage and carbon emissions are of strategic importance to the company, disclosure of the relevant information may be included in the Strategic Report instead of the Directors’ Report. Information relating to energy usage and carbon emissions should be included in the Strategic Report if it is considered necessary for an understanding of the development, position or performance of the company or the impact of its activities. Where information is promoted to the Strategic Report as it is of strategic importance, then a statement explaining this has been done must be included in the Directors’ Report.

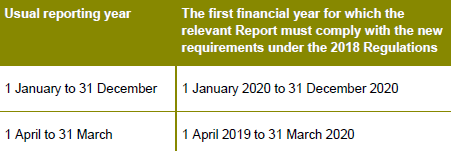

Timescale and deadlines

Quoted companies have been required to make carbon disclosures in their Directors’ Reports since 30th September 2013. The new requirements, imposed by the 2018 Regulations on quoted companies and on large unquoted companies and large LLPs apply to reports for financial years starting on or after 1st April 2019. The table below gives an example of the first financial year for which the relevant Report must comply with SECR for organisations with different reporting year start dates. The first publication of reports which must comply with the 2018 Regulations is therefore expected to be filed with Companies House in 2020 (e.g. those which cover financial years to 31st March 2020). You will need to check what financial year your organisation uses. Usually companies have nine months to submit their annual reports after the reporting periods. For example for the reporting period 1st January 2020 to 31st December 2020 the deadline should be 30th September 2021. A special pandemic extension applied for the reporting period 1st April 2019 to 31st March 2020, with the deadline moving backwards to 31st March 2021 rather than 31st December 2020. Check with your finance director or company secretary if you are unsure.