- November 11, 2024

2025 GRESB Real Estate & Infrastructure Standards updates

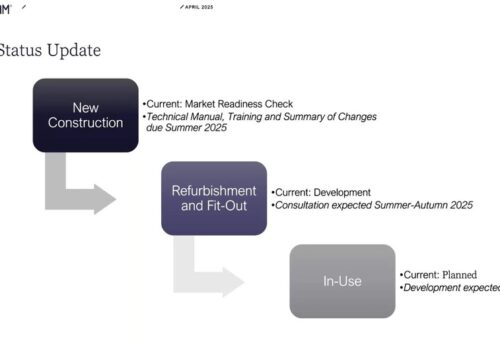

GRESB’s latest 2025 Standards bring important updates for Real Estate participants, designed to align with today’s ESG demands while offering greater predictability for future reporting. Here’s what you need to know:

- Performance Recognition Enhancements: Improvements to the like-for-like scoring methodology to reward operationally efficient assets and acknowledge that for highly efficient buildings, year-on-year reductions in energy consumption may not be achievable.

- Sector-Specific Focus: GRESB is introducing tailored metrics for residential assets, marking the first step in sector-specific scoring. This supplemental scoring approach considers the unique ESG aspects of residential properties, providing targeted insights without impacting core scores in 2025.

- Data Collection for Future Scoring: Expanded data collection on renewable energy and embodied carbon which will remain unscored in 2025, allowing participants to prepare for future scoring changes.

- New Biodiversity Indicator: A new, unscored indicator for biodiversity provides an experimental framework for reporting on nature-related strategies, with future integration likely.

- Increased Focus on Climate Change and Net Zero: Increased evidence guidance and score weighting for Net Zero targets, embodied carbon and climate change risk management.

- Reduced Reporting Burden: Introduction of an indicator retirement plan with the aim of streamlining reporting requirements by removing select indicators and focusing on key ESG areas which are deemed to be more significant differentiators in terms of ESG performance.

Impact Analysis Findings

Alongside the list of changes, GRESB have conducted an impact analysis, outlining the affect that the changes may have on participants assessments next year. This analysis includes:

- Energy Efficiency: Enhanced metrics in energy efficiency are projected to positively impact 2025 scores, rewarding participants with high-efficiency assets.

- Renewable Energy: Additional input for renewable energy procurement practices begins in 2025, without an immediate scoring impact, enabling participants to adapt ahead of potential future scoring.

- Embodied Carbon: Additional inputs for embodied carbon without scoring in 2025, including a new indicator to assess embodied carbon targets for development projects.

- Building Certifications: No impact in 2025, with a longer-term aim to differentiate between building certifications based on their quality.

- Biodiversity: A new, unscored biodiversity indicator is introduced, enabling participants to incorporate nature-related strategies without score changes in 2025.

- Employee Safety: Changes to employee safety scoring will require additional safety metrics to be collected to achieve full points.

- Indicator Retirement and Adjustments: The retirement of select indicators and weighting adjustment of other indicators from 2026 onwards to streamline the reporting process and reduce reporting burdens.

The table below offers an aggregated impact analysis broken down per topic, for approved and anticipated updates impacting the main

Real Estate Standard.

With multi-year guidance now in place, these updates offer participants clear pathways to adapt and prioritise key areas of ESG improvement. For a detailed breakdown, view the full GRESB Standards Update, and join GRESB’s Q&A on November 21 for further insights.